Instead of thinking of the best structure, think of the view you want to express and choose the best structure for that view. If this was the case nobody would take the other side of your trade. Q : “Which options strategies should I focus on, which are best?”Ī : “There is no ‘best’ options structure. In this case while you still made money you may have profited more from trading another options structure over the one you traded. price) more than it is losing off of another component (ex. Q : “My strategy seems to work for me but the view expressed here is a little different than I thought, what should I do?”Ī : “Most likely your structure is profiting off of one component (ex. Still not so sure? Here are answers to some of the most common questions about choosing the right options structure. If not the simpler Bear Call Spread will benefit from a falling price and overpriced volatility. This structure could work better if the investor was very confident in their specific view of a small decrease in share price. The one exception is that the broken wings butterfly has a better risk to reward if we move down only slightly but fails to perform if the stock moves down more.

#The cheat sheet book pdf pdf

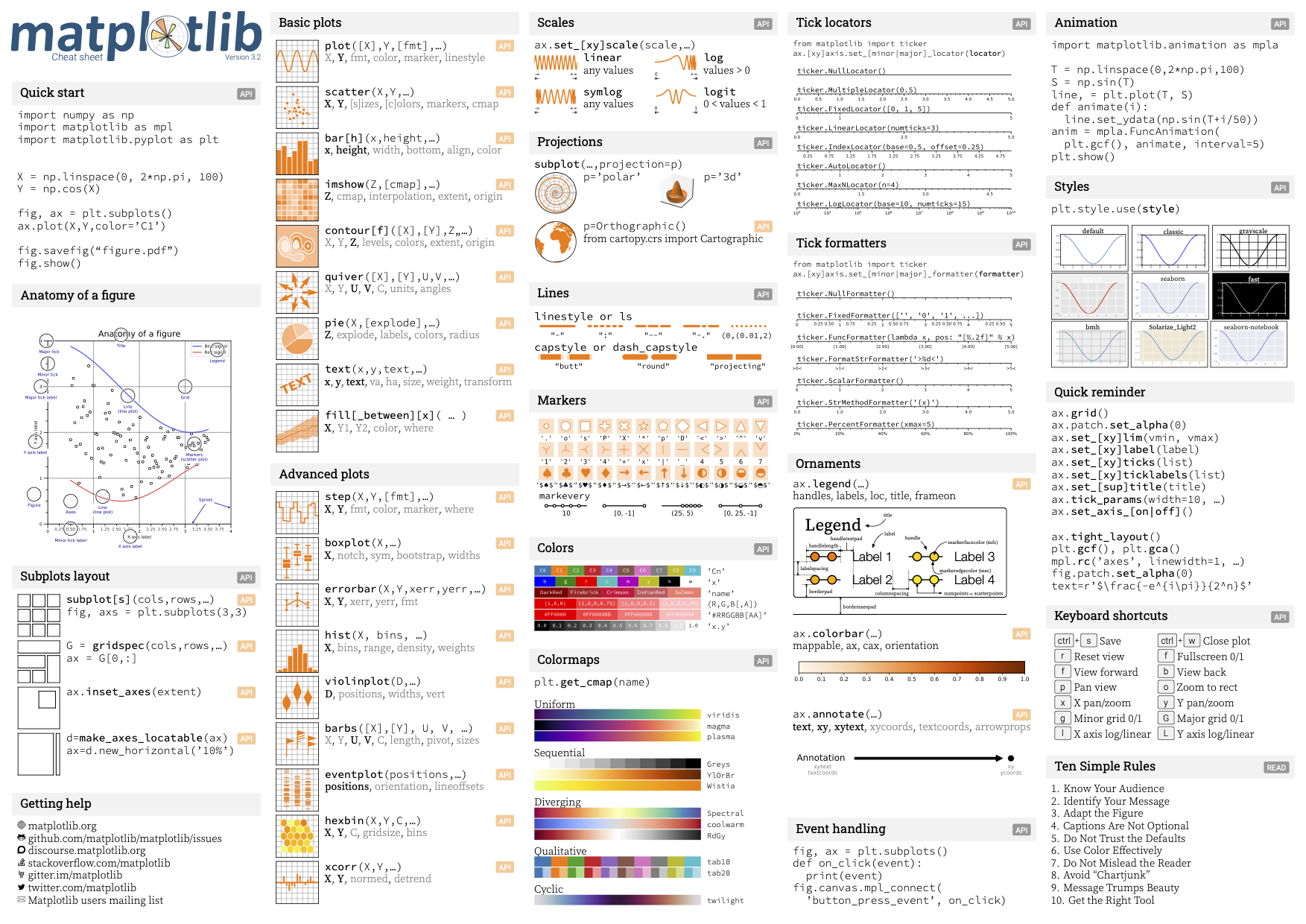

The image below is a little blurry, so you can download the original pdf here.īy looking for Bearish directional trade, falling volatility and a risk defined structure we are left with two choices the Bear Call Spread and the Broken Wings Butterfly with Calls. Using our cheat sheet we can tick off our boxes one by one to find the structure that best suits our needs. We are also relatively new to options so want to have a position with a defined risk if we are wrong in our view. If it does move, we think it will move down. Let’s imagine we have the view that a stock will not move too much over this coming month. It all depends on choosing the right structure for the view an investor wants to express. If a beginner has a well-defined knowledge of a more advanced options strategy, as long as they are fully aware of the risks, they can definitely trade the structure.Ĭonversely, there is no inherent “advantage” to the more advanced strategies. These can result in traders risking significantly more than they had in mind, which can be painful when it goes against you. We have also grouped options strategies into levels of difficulty ranging from beginner to advanced.Ĭertain options structures, especially those with undefined risk or complex payoffs are more challenging for new options traders. To check a structure and the view it expresses or to find a structure with the view that an investor has. In this way, the cheat sheet can be used in two ways. Together, these categories express the view that each specific options structure has. In the sheet, each options structure is shown with a below visual payoff graph. This version include risk graphs for visual learners We have found that even for intermediate options traders having the sheet can be useful as it serves as a checklist to make sure it is a trade you actually want to take and you are expressing it in the right way.Ĭlick Here for a PDF copy of the Options Strategies Cheat Sheet So instead of searching up an options structure every time you come across something new you can simply refer to the guide. Nevertheless, for a new options trader, with so many possible structures, it can be challenging.įor one, it can be difficult to understand which structure to trade and what view it expresses.Īlso, when starting to trade options, it is often unclear which structures are best suited for beginners.Įven if you are not trading yet, when reading articles or opinion pieces online, unless the author clearly expresses their view, it can be difficult to understand what exactly they wanted to trade with the structure they put on.įor this reason, we thought it would be beneficial to create a one-page “Cheat Sheet” for new options traders. This versatility is one of the biggest advantages options have over trading the underlying stock. Below you can download two versions of an option strategy cheat sheet.

Options allow investors to choose an almost unlimited number of structures to express different views on what a stock will do.

0 kommentar(er)

0 kommentar(er)